MDP, a leading provider of payments technology across the Middle East and Africa

has announced its rebranding to Modupay, marking the next phase in the evolution of

its flexible, end-to-end payments platform This change reflects the company’s expansion into

a comprehensive and scalable payments solution catering to banks, fintechs, telcos, and non-banking

financial institutions across the region

A New Era for Payments Technology: Modupay’s Vision for the Future

The rebrand to Modupay signals a clear shift in the company’s identity, capturing both its

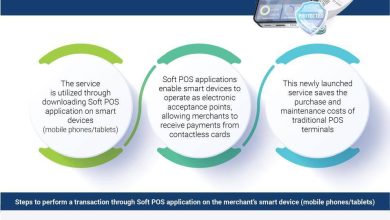

current capabilities and its future aspirations Through Modupay, the company integrates

card issuance, payment processing, digital payments solutions, and data-driven insights

within a modular platform that can be configured, adapted, and scaled to meet the evolving

needs of institutions Ahmed Nafie, CEO of Modupay, explained, “This is an evolution of our

brand, not a change in our operations We started as a card manufacturer with a simple goal

to provide reliable payment solutions to our partners As the payments landscape evolved, we

adapted expanding into payment processing and then digital payments to address our clients

growing needs What has remained unchanged is our platform, our team, and our unwavering

commitment to our partners

Modupay’s Expanded Offerings: Flexibility and Scalability at the Core

The company’s journey has seen its offerings evolve beyond the single-product model

positioning Modupay as a comprehensive, modular platform capable of delivering customized

and scalable payment solutions The rebranding reinforces this transition, highlighting Modupay’s

ability to offer flexibility, scalability, and control, allowing institutions to seamlessly adopt solutions

tailored to their requirements Modupay reflects who we are today and the role we play in

empowering institutions to launch, operate, and grow with confidence We are proud to have

transitioned from a card manufacturing business to a leading payments technology enabler, now

backed by over 620 employees and operations in more than 40 countries, said Nafie With

dedicated teams in Ghana, Kenya, and Libya, we ensure that we remain accessible and responsive

to our partners wherever they are

Client-Centric Values and Commitment to Innovation

At the core of Modupay’s mission is a commitment to putting clients at the heart

of everything it does The rebrand underscores the company’s core values of integrity

collaboration, and listening to partner needs This approach ensures that institutions are

equipped with solutions that enable them to move faster, adapt smarter, and thrive in the

ever-changing payments landscape The evolution of Modupay reflects our dedication to

continuous innovation and our deep understanding of the regional financial ecosystem

Nafie added We remain focused on supporting the growth of the payments industry in

the Middle East, Africa, and beyond, providing a future-ready payments infrastructure that

meets the demands of both today and tomorrow

About Modupay

Modupay is a leading provider of payments technology solutions across the

Middle East and Africa, helping banks, fintechs, telcos, and non-banking financial

institutions build, launch, and operate payment products with enhanced flexibility

and control Formerly known as MDP, Modupay offers a modular and scalable platform

that integrates card issuance, payment processing, digital payment solutions, data and

insights, and regulatory compliance With more than 30 years of experience in the payments

ecosystem, Modupay serves its partners across the full payments lifecycle ranging from

personalized card production to financial transaction processing and digital payments

Headquartered in Cairo, Egypt, Modupay operates in over 40 countries, supported by a

team of 620+ professionals The company maintains close ties with its partners through

on-the-ground teams in key regional markets like Ghana, Kenya, and Libya