Central Bank of Egypt Launches Contactless Payment Acceptance via Smart Devices to Boost Financial Inclusion

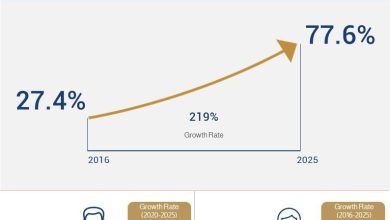

The Central Bank of Egypt (CBE) has announced the official launch of a contactless electronic payment acceptance service through smart devices, including mobile phones and tablets, using Soft POS applications. The move comes as part of the CBE’s ongoing efforts to facilitate electronic financial transactions, reduce reliance on cash, and promote financial inclusion, in line with Egypt’s Vision 2030.

Smart Devices Transformed into Secure Payment Acceptance Points

The newly launched service enables merchants to convert smart devices into electronic payment acceptance points, allowing them to accept payments from contactless bank cards in their various forms. By downloading a Soft POS application on their mobile phone or tablet, merchants can process transactions securely, with card PINs entered directly on the smart device in a manner that is internationally certified and highly secure.

CBE Governor: Expanding Digital Payments and Financial Access

Commenting on the launch, H.E. Mr. Hassan Abdalla, Governor of the Central Bank of Egypt, stated that the new service reflects the CBE’s continued efforts to strengthen the infrastructure for electronic payment systems and simplify financial transactions for citizens and merchants.

He emphasized that the initiative supports the expansion of financial inclusion, while enhancing access to electronic financial services anytime and anywhere, contributing to a more efficient and inclusive digital economy.

Lower Costs and Greater Inclusion for Small Enterprises

The service significantly reduces costs for payment service providers, companies, and merchants by eliminating the need to purchase and maintain traditional POS terminals. It also facilitates the integration of small and micro enterprises into the electronic payment acceptance ecosystem.

In addition, the solution enhances the customer payment experience by offering faster, more secure, and flexible payment options, supporting wider adoption of digital payments across different sectors.

Official Launch Following a Successful Pilot Phase

It is worth noting that the CBE had previously launched a pilot phase of the service in earlier years, with a transaction limit of EGP 600. The latest update and official rollout mark a key step in the CBE’s ongoing commitment to develop payment services and strengthen digital financial infrastructure.

This initiative aligns with global advancements in electronic payments, while equipping merchants and payment service providers with low-cost, flexible e-payment acceptance solutions via smartphones, reinforcing Egypt’s transition toward a cash-light economy.