The Central Bank of Egypt (CBE) recently hosted a landmark seminar titled “Current and Emerging

Regulatory Developments”, welcoming representatives from 23 African central banks.

This event reflects the CBE’s ongoing commitment to fostering collaboration across the

continent and sharing best practices in banking supervision.

The seminar addressed crucial topics under the Basel Accord frameworks, including Pillar II and

III, Emergency Liquidity Assistance (ELA), Recovery Plans, Sanctions, Governance, Cybersecurity

regulations, and FinTech innovations.

Experts emphasized enhancing risk management and preparing African central banks

for emerging financial challenges.

Central Bank of Egypt Advances Basel Accord Implementation

Deputy Governor of the CBE, Mr. Tarek El Kholy, highlighted the importance of regional integration:

“We always welcome cooperation and exchange of expertise with our brethren from African central

banks. This series of seminars organized and hosted by the CBE, as part of its chairmanship

of the Working Group on the implementation of Basel Accords, represents a role model for integration

among banking institutions.”

This seminar is part of the CBE-led Basel Implementation Working Group under the Community of

African Banking Supervisors (CABS), established during Egypt’s Annual Conference in June 2019.

It marks the first in-person seminar since 2021, following virtual sessions held during the pandemic.

Central Bank of Egypt Focuses on Pillar II and III Supervision

The seminar placed strong emphasis on strengthening supervisory frameworks based on

Basel Pillars II and III.

Participating banks discussed practical approaches to risk management, recovery planning, and

regulatory compliance.

The sessions provided a platform for knowledge-sharing and capacity-building across the continent.

Central Bank of Egypt Tackles Cybersecurity and FinTech Challenges

Given the rapid evolution of digital banking, the CBE addressed emerging regulatory

needs around cybersecurity and FinTech.

Experts presented case studies and regulatory guidelines to help African banks manage

technological risks while supporting financial innovation.

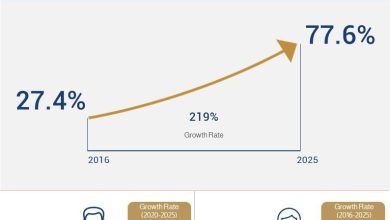

Since 2021, the CBE has hosted multiple virtual seminars under the Basel Implementation

Working Group, covering topics such as:

Basel III Post-Crisis Reforms (2022)

Climate-Related Financial Risks and Sustainable Finance (2023)

Effective Supervision: Building Supervisory Frameworks and Risk Management (2024)

These events have strengthened knowledge-sharing and professional development for African central bank officials.

Driving Continental Banking Integration

The seminar demonstrates Egypt’s leadership role in African banking supervision.

By promoting collaboration and capacity-building, the CBE continues to enhance regulatory

efficiency and financial stability across the continent.