Central Bank of Egypt Launches MasterTalks Series to Promote Innovation and Financial Inclusion

The Central Bank of Egypt (CBE), in partnership with the European Bank for

Reconstruction and Development (EBRD), has launched a series of Masterclasses called

MasterTalks to support best practices in inclusive banking, advance knowledge, and foster

innovation across the banking sector, in cooperation with the Federation of Egyptian Banks (FEB).

Broad Participation from Banking Leaders

The inaugural event brought together heads of Micro, Small, and Medium-sized Enterprises (MSMEs)

units, financial inclusion managers from banks, and key stakeholders from Egypt’s financial

ecosystem, including the Credit Guarantee Company (CGC), the Egyptian Credit Bureau

(i-Score), and the Egyptian Banking Institute (EBI).

International speakers also joined the dialogue to explore challenges in operationalizing

Artificial Intelligence (AI) and global use cases tailored for emerging markets.

Focus on Digital Transformation and Financial Inclusion

The MasterTalks series emphasizes the importance of digital transformation in modernizing the banking

industry and demonstrates how emerging technologies can be integrated into financial systems.

Discussions highlighted the role of AI tools in improving access to financial and non-financial services for

individuals and MSMEs, helping meet diverse needs and opening new opportunities for financially excluded segments.

Supporting Innovation and Banking Capacity Building

This joint initiative reflects the Central Bank and EBRD’s focus on supporting innovation, enhancing banking sector

capacity, and promoting inclusive and sustainable growth within Egypt’s financial system.

It also underscores the CBE’s commitment to advancing financial inclusion, in line with Egypt

Vision 2030, aiming to economically empower citizens and expand access to banking services

through modern technological innovations.

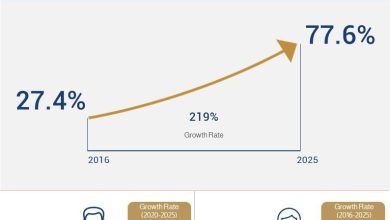

Remarkable Growth in Financial Inclusion

These efforts have contributed to significant progress in financial inclusion in Egypt, with the rate reaching

76.3% as of June 2025, marking a 214% increase since 2016.

Over the same period, bank lending portfolios directed to MSMEs recorded a 395% growth.

EBRD’s Role in Egypt

Egypt is a founding member of the EBRD.

Since the start of the Bank’s operations in the country in 2012, the EBRD has invested

over €13.5 billion across 206 projects.