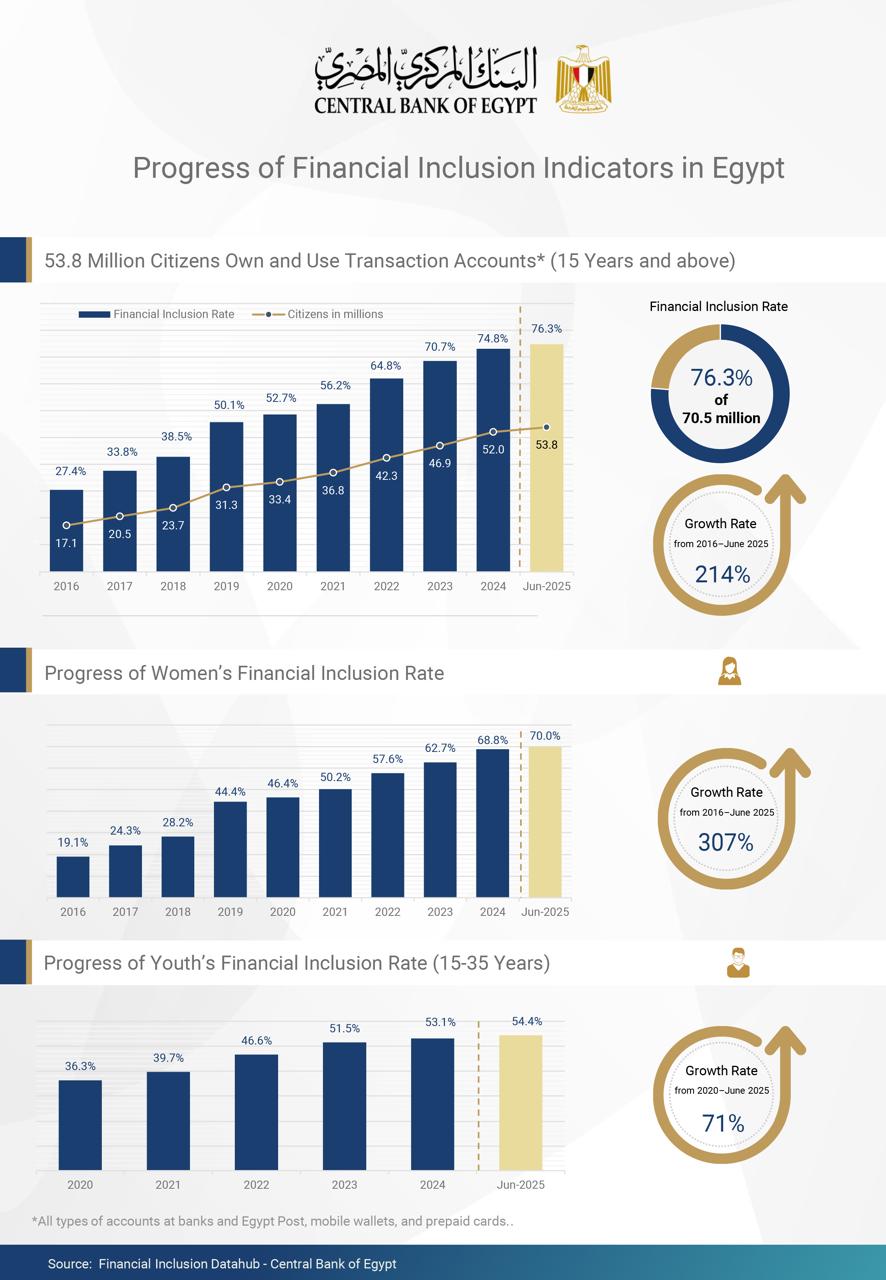

The Central Bank of Egypt (CBE) has announced a notable rise in financial inclusion rates

in Egypt, with 76.3% of the adult population (aged 15 and above) now owning and actively

using financial accounts as of June 2025 This translates to 53.8 million citizens engaging in financial

transactions through bank accounts, Egypt Post accounts, mobile wallets, or prepaid cards, according

to the latest core indicators published by the CBE This marks an increase from 74.8% recorded in

December 2024, reflecting the progress made under the framework of the Financial Inclusion Strategy (2022–2025)

Women’s Financial Inclusion in Egypt Rises to 70%

A key highlight of the report is the advancement in women’s access to financial services in Egypt

with the female financial inclusion rate reaching 70% in June 2025, up from 68.8% in December 2024

This improvement underscores the CBE’s commitment to women’s economic empowerment, in collaboration

with relevant ministries and stakeholders. These efforts aim to increase women’s financial independence

by expanding their access to formal financial tools and services

Youth Financial Inclusion Continues to Improve

Central Bank The financial inclusion rate among youth also showed steady growth, rising to 54.4% in June

2025 compared to 53.1% in December 2024. This increase is fueled by strategic initiatives from the CBE

including the authorization for youth aged 15 and above to open bank accounts, thus promoting early financial

literacy and inclusion

Financial Inclusion in Egypt Grows by 214% Since 2016

From 2016 to mid-2025, financial inclusion in Egypt has expanded by an impressive 214%, highlighting

a major transformation in citizens’ engagement with formal financial systems. This surge is a testament

to the country’s robust policy framework and its dedication to bridging the financial gap across diverse

population segments

Central Bank: Key Pillars and Enablers

The Financial Inclusion Strategy (2022–2025) developed by the Central Bank of Egypt is grounded

in data-driven approaches to monitor and enhance financial inclusion across the nation It focuses

on three main dimensions

Accessibility to financial services

Usage of accounts and services

Quality of financial offerings

To achieve its strategic goals, the CBE emphasizes

Diversification of financial products and services tailored to the needs of various customer

segments (banking and non-banking)

Establishment of inclusive regulatory and legislative frameworks

Promoting the integration of all social segments into the formal financial system

Enhancing financial education and digital transformation

The latest data from the Central Bank of Egypt confirms that the country is on a strong trajectory

toward comprehensive financial inclusion, with continuous efforts aimed at empowering women

engaging youth, and expanding access to reliable and quality financial services for all As Egypt

moves closer to realizing the goals of its Financial Inclusion Strategy 2025, the results reflect a

growing trust in and reliance on the formal financial ecosystem