,The Financial Soundness Indicators have underscored the resilience and robustness of the banking sector as a key pillar

.supporting the state’s efforts to achieve economic, financial, and monetary stability

,This resilience is reflected in the banking sector’s ability to provide financing for various economic sectors

.contributing to the increase of Gross Domestic Product (GDP), and achieving high growth and investment rates, as well as creating job opportunities for all citizens

Additionally, the capital adequacy ratio reached 19.1% by the end of Q3 2024, marking an increase of 0.5%, compared to a minimum regulatory requirement of 12.5%.

.Regarding the asset quality, ratio of non-performing loans (NPLs) declined to 2.4% of total loans, with the provisions’ coverage ratio for NPLs reaching 87.4%

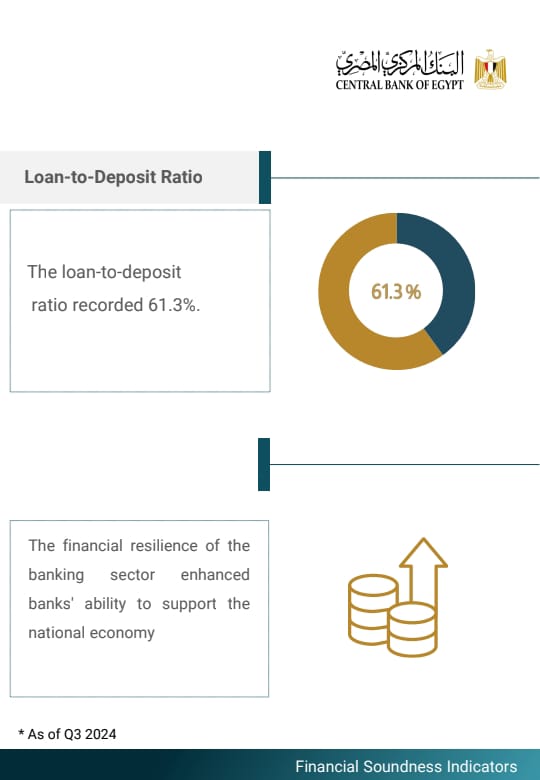

,Moreover, the indicators reflected the maintenance of high and stabilized liquidity rates in both local and foreign currencies, which recorded 32.1% and 77.7%

.respectively, compared to minimum regulatory requirement of 20% and 25%respectively. As for the loan-to-deposit ratio, it marked 61.3% by the end of Q3 2024

.These indicators confirmed the preservation of high profit margins, with a return on equity of 32.2%, by the end of FY2023

,In this regard, the financial resilience of the banking sector fosters banks’ ability to support the national economy

,maintained by the regulatory framework of the Central Bank of Egypt (CBE), which closely monitors the performance of all banks

.and ensures their adherence to international best practices in achieving financial stability